Life Insurance In Toccoa Ga Things To Know Before You Buy

Wiki Article

The 10-Minute Rule for Annuities In Toccoa Ga

Table of ContentsThe Greatest Guide To Affordable Care Act Aca In Toccoa GaThe Best Strategy To Use For Medicare Medicaid In Toccoa GaNot known Details About Life Insurance In Toccoa Ga Some Known Details About Annuities In Toccoa Ga

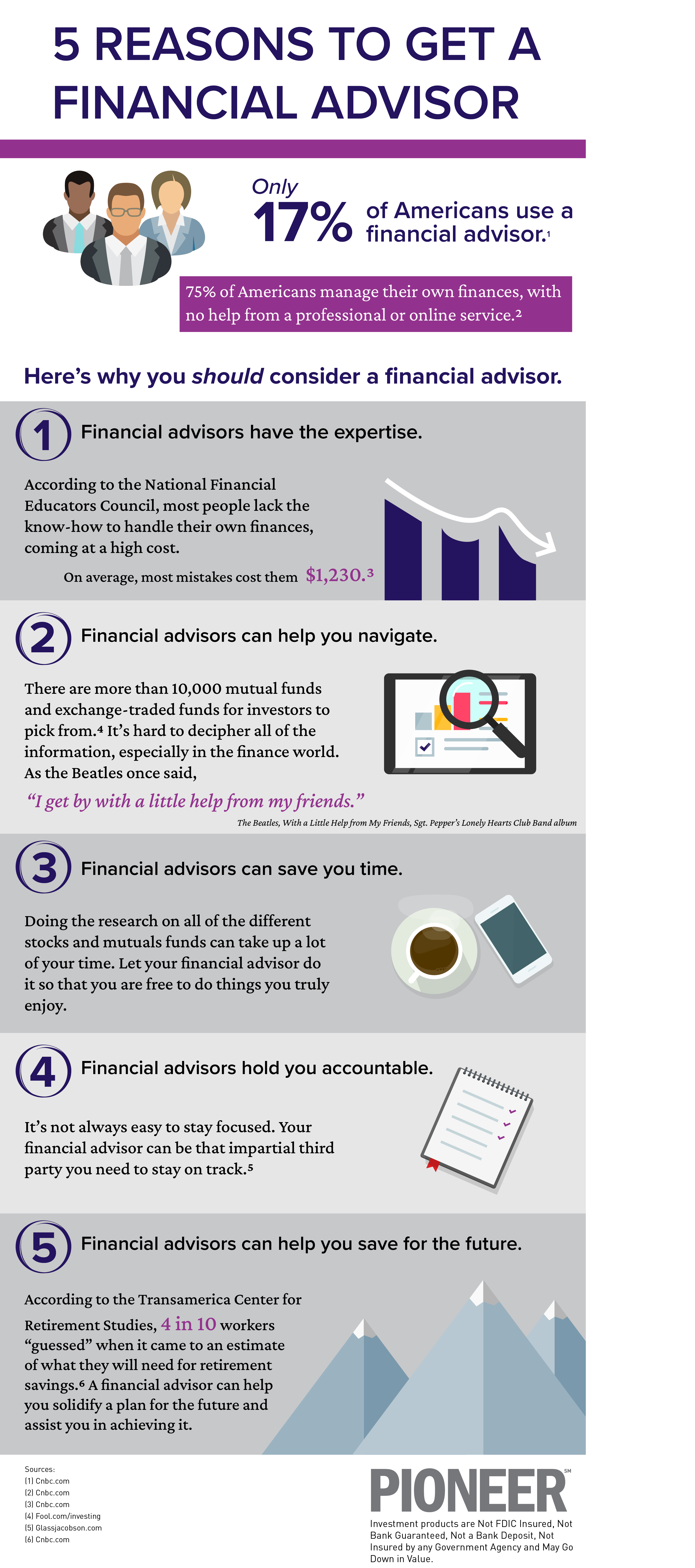

A financial consultant can likewise aid you decide exactly how best to achieve goals like saving for your youngster's university education and learning or settling your financial obligation. Although monetary consultants are not as well-versed in tax regulation as an accountant may be, they can offer some assistance in the tax planning process.Some monetary consultants offer estate preparation services to their clients. They could be learnt estate planning, or they might wish to deal with your estate attorney to answer concerns concerning life insurance policy, trusts and what should be made with your investments after you pass away. Lastly, it is essential for financial experts to remain up to date with the market, financial conditions and consultatory ideal techniques.

To sell investment items, advisors have to pass the pertinent Financial Sector Regulatory Authority-administered exams such as the SIE or Series 6 exams to acquire their accreditation. Advisors that desire to sell annuities or various other insurance coverage items have to have a state insurance permit in the state in which they intend to sell them.

The Single Strategy To Use For Automobile Insurance In Toccoa Ga

Allow's state you have $5 million in assets to take care of. You work with a consultant that charges you 0. 50% of AUM per year to help you. This indicates that the advisor will obtain $25,000 a year in fees for handling your financial investments. As a result of the normal fee framework, numerous experts will not function with clients that have under $1 million in possessions to be managed.Capitalists with smaller profiles could seek an economic advisor that charges a per hour charge as opposed to a percentage of AUM. Per hour costs for experts commonly run between $200 and $400 an hour. The more complicated your economic scenario is, the even more time your expert will have to devote to handling your properties, making it more pricey.

Advisors are knowledgeable specialists that can help you develop a plan for monetary success and execute it. You could additionally consider getting to out to an expert if your personal monetary circumstances have recently come to be much more challenging. This can imply getting a residence, marrying, having children or obtaining a huge inheritance.

9 Easy Facts About Affordable Care Act Aca In Toccoa Ga Explained

Before you meet with the advisor for an initial assessment, consider what services are most crucial to you. You'll desire to seek review out a consultant who has experience with the solutions you desire.What company were you in prior to you got right into monetary recommending? Will I be working with you straight or with an associate expert? You might additionally want to look at some sample financial strategies from the consultant.

If all the samples you're given are the very same or similar, it might be an indicator that this consultant does not correctly tailor their suggestions for every client. There are 3 primary sorts of financial recommending experts: Qualified Economic Organizer specialists, Chartered Financial Experts and Personal Financial Specialists - https://flipboard.com/@jstinsurance1/-health-insurance-in-toccoa-georgia/a-yPD6uT75Q9y3EjmPdHarjA%3Aa%3A4045383819-e6c58aa3fb%2Fjstinsurance.com. The Qualified Financial Organizer professional (CFP professional) accreditation shows that an expert has actually satisfied an expert and ethical requirement set by the CFP Board

The Medicare Medicaid In Toccoa Ga PDFs

When selecting a financial consultant, think about a person with an expert credential like a CFP or CFA - https://www.intensedebate.com/profiles/jstinsurance1. You could also consider an advisor who has experience in the services that are most crucial to youThese experts are generally filled with conflicts of interest they're more salespeople than advisors. That's why it's vital that you have a consultant who works only in your best passion. If you're searching for an advisor who can truly provide actual worth to you, it is essential to look into a variety of possible alternatives, not simply pick the very first name that markets to you.

Currently, several advisors have to act in your "ideal interest," however what that entails can be nearly unenforceable, except in the most outright cases. You'll need to locate a genuine fiduciary.

"They need to prove it to you by showing they have taken serious continuous training in retirement tax and estate preparation," he states. "You need to not spend with any kind of consultant that doesn't invest in their education.

Report this wiki page